When it comes to managing our finances, many of us find ourselves overwhelmed and unsure about where to start. We know that creating a budget is essential, but the mere thought of tracking expenses and making financial decisions can be daunting. Believe me, I’ve been there too. However, once I realized the importance of budgeting and discovered some simple strategies, I was able to take control of my finances and make smarter financial choices. In this blog post, I will share with you the budgeting basics that helped me create and stick to a budget.

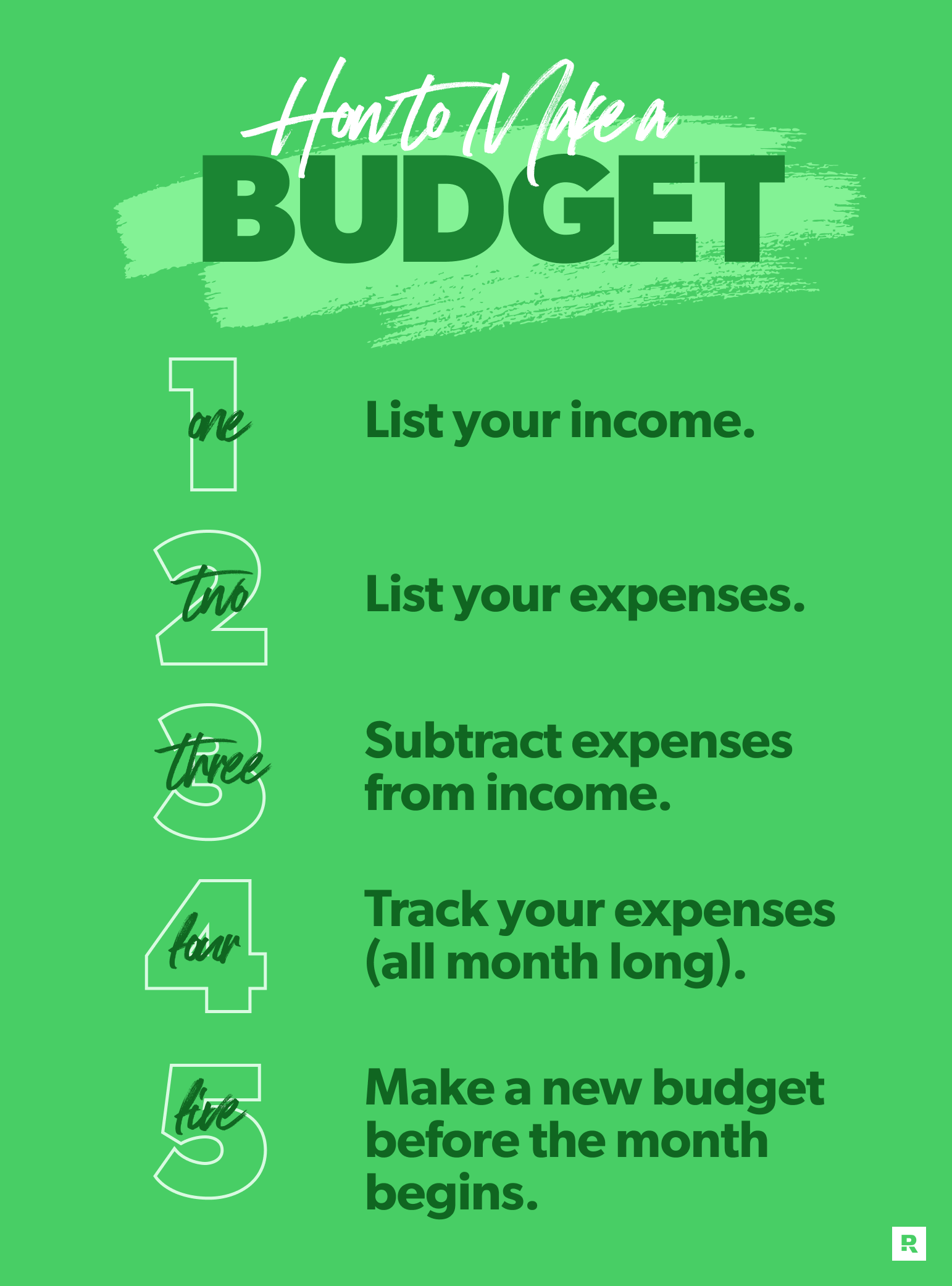

First and foremost, creating a budget requires understanding your income and expenses. Start by listing all your sources of income, including your salary, side hustle earnings, and any other sources of money. Then, it’s time to dig into your expenses. Make a comprehensive list of everything you spend money on, including both fixed expenses like rent, utilities, and loan payments, as well as variable expenses like groceries, entertainment, and transportation.

Once you have a clear picture of your income and expenses, it’s time to evaluate your spending patterns and identify areas where you can make adjustments. Look for any unnecessary expenses that can be reduced or eliminated altogether. This is not about depriving yourself but rather about making conscious choices that align with your financial goals.

One strategy that helped me stay on track with my budget was the 50/30/20 rule. This rule suggests allocating 50% of your income towards essential expenses like housing, utilities, and transportation, 30% towards discretionary spending such as dining out or entertainment, and 20% towards savings and debt repayment. Of course, these percentages can be adjusted to fit your specific circumstances, but the key is to find a balance that allows you to meet your financial goals while enjoying your life.

To ensure that you stick to your budget, it’s important to track your expenses regularly. In the past, I found this to be a tedious task, but thanks to technology, it’s become much more manageable. Nowadays, there are numerous budgeting apps and online tools available that make tracking expenses a breeze. Find one that suits your needs and start using it to record your expenses regularly. Seeing how your money is being spent will not only help you stay on track but also provide valuable insights into your spending habits.

Another important aspect of budgeting is setting realistic financial goals. Whether you want to save for a down payment on a house, pay off debt, or take a dream vacation, having a clear goal in mind will motivate you to stay committed to your budget. Break down your goals into smaller, manageable milestones, and track your progress along the way. Celebrate each achievement, no matter how small, as it will keep you motivated and encouraged to continue on your financial journey.

One aspect of budgeting that often gets overlooked is the importance of building an emergency fund. Life is full of unexpected surprises, and having a financial cushion can provide security and peace of mind during challenging times. Aim to set aside 3-6 months’ worth of living expenses as an emergency fund. Start small, even if it means putting away a few dollars every week. Over time, your emergency fund will grow, offering you a sense of financial stability.

Lastly, consider adopting a cash-only approach for certain discretionary categories. Research has shown that using cash instead of cards can make us more aware of our spending habits and less likely to overspend. Designate an envelope or jar for categories like entertainment or dining out, fill them with a predetermined amount of cash each month, and commit to only spending what’s available in those envelopes. This simple switch can help you become more mindful of your spending and prevent you from dipping into other budget categories.

In conclusion, budgeting is a powerful tool that can transform your financial life. By taking the time to evaluate your income and expenses, setting realistic goals, and staying committed to tracking your spending, you can create a budget that works for you. Remember, budgeting is a journey, not a one-time task. Be patient with yourself, make adjustments along the way, and celebrate your milestones. Over time, you will develop healthy financial habits that will pave the way for a brighter financial future.