When it comes to building wealth, many people have different ideas and strategies. Some may focus on investing in the stock market, while others may concentrate on real estate or starting their own businesses. While these avenues can be great wealth-building opportunities, I believe that a combination of personal discipline, smart financial planning, and continuous education is the key to long-term financial success.

Growing up, my family never had much money. We lived paycheck to paycheck, struggling to make ends meet. Witnessing my parents’ financial hardships made me realize from a young age that I didn’t want to live in constant financial stress. I made a firm decision to break the cycle of living from one paycheck to another and to strive for long-term financial stability.

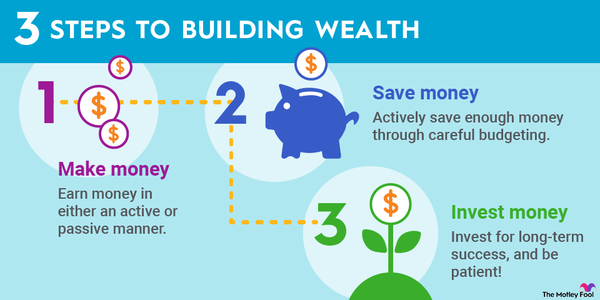

Initially, building wealth seemed like a daunting task. However, I quickly learned that it all starts with discipline. It’s crucial to develop healthy financial habits, such as budgeting, saving, and avoiding unnecessary debt. Creating a budget allows you to track your income and expenses, ensuring that you spend less than what you earn. This may require making sacrifices and cutting back on non-essential expenses. By minimizing frivolous spending, you can divert those funds towards savings or investments.

Saving money is a fundamental step towards building wealth. Set a savings goal and automate monthly contributions to your savings account. This way, you treat savings as a non-negotiable expense and learn to live within your means without relying on credit cards or loans.

However, simply saving money is not enough. To maximize your wealth-building potential, you must invest wisely. Investing allows your money to grow over time and beat the eroding effects of inflation. Before jumping into the world of investing, it’s essential to educate yourself about various investment vehicles, like stocks, bonds, mutual funds, and real estate. Understanding the risks and potential returns associated with each investment option is crucial.

To educate myself further, I attended workshops, read books, and followed financial podcasts. Albert Einstein once said, “The only source of knowledge is experience.” I took his words to heart and learned as much as I could from experienced investors and financial experts.

As I learned about investments, I realized the importance of diversification. Diversifying your investments across different asset classes helps minimize risk. If one investment performs poorly, the others may help offset the losses. Asset allocation is a crucial aspect of diversification. Allocating your investments to different sectors, geographic regions, and investment types can provide added stability to your portfolio.

Real estate investment has been an avenue that many people have found success in. Owning income-generating properties can provide a steady stream of cash flow and potential appreciation over time. However, it is vital to conduct thorough research, analyze the market, and consider factors like location, property condition, and potential rental income before investing in real estate.

Building wealth is not a short-term endeavor; it requires patience and a long-term perspective. One of the most significant mistakes people make is trying to get rich quickly. The reality is that most overnight successes are years in the making. It’s crucial to develop a long-term mindset and invest in assets that have the potential to grow steadily over time.

Alongside long-term investments, it is also essential to have an emergency fund. Life can throw unexpected curveballs, such as medical emergencies or job loss. Having a readily available emergency fund can help you weather these storms without derailing your long-term financial goals.

Furthermore, building wealth isn’t just about accumulating money; it’s also about protecting what you have. Insurance plays a vital role in safeguarding your assets and loved ones. Health insurance, life insurance, and property insurance are necessary to protect against unforeseen circumstances that could potentially wipe out your hard-earned wealth.

Lastly, when building wealth, it’s essential to periodically review and reassess your financial plans. Life is ever-changing, and your financial strategies should evolve accordingly. Regularly monitor your investments, update your budget, and adjust your strategies as needed. Seek advice from financial advisors or professionals who can provide guidance and help keep you accountable.

In conclusion, building wealth requires discipline, smart financial planning, and continuous education. It starts with developing healthy financial habits, saving, and investing wisely. The path to success may be challenging, but with determination and patience, long-term financial stability and wealth can be achieved. Remember, building wealth is about more than just money; it’s about creating a secure future for yourself and the ones you love.