Are you tired of being rejected for loans or paying high interest rates on credit cards? Do you want to improve your financial reputation and have more control over your future? If so, you’re in the right place. In this blog post, I’ll share with you some personal experiences and tips on how to boost your credit score.

A few years ago, I found myself in a tough financial situation. I had made some poor decisions in managing my finances, and as a result, my credit score took a hit. I was struggling to get approved for credit cards or loans, and even when I did, the interest rates were astronomical. It was incredibly frustrating, and I knew I had to do something about it.

The first step I took was to educate myself about credit scores and how they are calculated. I learned that factors such as payment history, credit utilization, length of credit history, and types of credit all play a role in determining your score. Armed with this knowledge, I developed a plan to improve my credit score.

The most important aspect I focused on was my payment history. I made it a priority to pay all my bills on time, whether it was my credit card statement or my monthly utility bills. Late payments can significantly impact your score, so it’s crucial to stay on top of your due dates. To make it easier, I set up automatic payments for some of my bills, ensuring that I never missed a payment again.

Another factor I worked on was my credit utilization ratio – the amount of credit I was using compared to my available credit limit. I made a conscious effort to keep my credit card balances low, aiming for a utilization ratio of less than 30%. By paying off my credit card balances in full each month, I was able to keep my utilization ratio in check and see a noticeable improvement in my credit score over time.

In addition to these two key factors, I also paid attention to the length of my credit history. It’s essential to have a long credit history as it demonstrates your ability to manage credit responsibly over time. If you’re new to credit, don’t worry! You can start building your credit history by becoming an authorized user on someone else’s credit card or applying for a secured credit card. Just make sure to use these cards responsibly and make timely payments.

I also diversified my credit by adding different types of credit to my portfolio. This means having a mix of revolving credit (like credit cards) and installment loans (such as car loans or mortgages). Having a diverse credit mix shows lenders that you can handle different types of credit responsibly.

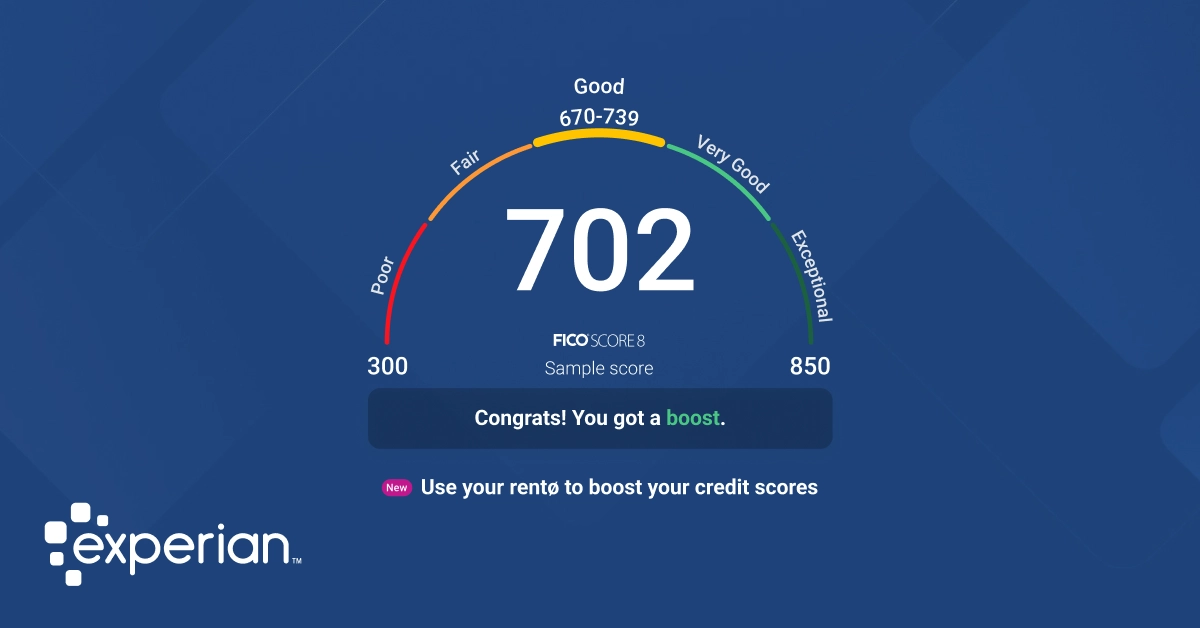

While these strategies helped me boost my credit score, there’s one more important tip I want to share – regularly reviewing your credit report. You’re entitled to a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) annually. Reviewing your report allows you to identify any errors or fraudulent activity and take steps to correct them. A clean and accurate credit report is essential for maintaining a good credit score.

Improving my credit score wasn’t easy, but with determination and discipline, I was able to turn my financial reputation around. Today, I’m proud to say that my credit score is in excellent shape, and I have better opportunities for loans and credit cards. But remember, it’s a journey that requires patience and consistency.

If you’re struggling with a low credit score or want to proactively improve your financial reputation, take heart. Start by understanding how credit scores are calculated and then develop a plan that addresses the key factors that influence your score. Whether it’s focusing on payment history, credit utilization, length of credit history, credit mix, or reviewing your credit report, every step you take will bring you closer to your goal.

In conclusion, improving your credit score is not just about numbers. It’s about taking control of your financial future and putting yourself in a better position to achieve your goals. So, start today by implementing these tips and watch as your credit score boosts and your financial reputation improves. Good luck!